I am Jazmine Clark, a native of Chicago’s Englewood community and on staff with Storycatchers as the Executive Assistant and Recruitment Associate for Changing Voices. I took an interest in working with our Changing Voices Ensemble to tackle the problem of financial freedom and build generational wealth in Black and brown communities.

Overcoming a Common Experience

Growing up, I noticed the struggles my family members encountered living from paycheck to paycheck. A few times, we even lived without hot water and heat. I knew I did not want to live in poverty once I became an adult.

To break this cycle, I decided to be the first to graduate from a 4-year university. When I graduated from Chicago State University, I interned at the Hyatt Corporation in the Diversity & Inclusion Department. A year later I was hired full-time. At that point, I knew I had broken my family’s poverty cycle.

When I got a bit older, my fiancé suggested we invest our money into property. I had the necessary funds and long-term job history. But what I did not have was good credit. My credit score was low because of student loans and credit card debt. After two years of strengthening my credit score by putting my loans in default and making payment plans for my hospital bills, at age 31, I was able to purchase our first four-unit building.

In comparison, some of my white peers from college bought their first property right after graduation. Now, what is the difference between my white peers and myself?

Well, in my case, and for so many Black families in my neighborhood, it was the lack of knowledge about finances and wealth building. As a young girl, it was an unfortunate reality that the public schools I attended—Guggenheim Elementary School and Hirsh High School—lacked resources to teach us how to manage money. My parents couldn’t share advice other than, “Stay in school, and get your education.” So now as an adult, I have to put my big girl pants on and learn the money game for myself.

I’m writing this to help our youth remedy that longstanding problem — to help people kick off the shoes I used to walk in, build generational wealth, and thrive in our community.

For our Changing Voices Ensemble and other young adults who need to break the cycle of poverty while supporting their Black and brown communities, here are…

Four Actions to Build Generational Wealth in Black Communities

Understand American History and the Racial Wealth Gap

One of the most harmful aspects of systemic racism, created by the US Federal Housing Administration, is known as redlining. In the 1930s, redlining was a policy created to deny Black people mortgages, insurance, loans, and other financial services. This discriminatory federal housing policy blocked opportunities for Black people to purchase homes and build wealth by color-coding neighborhoods:

Green – Best | Blue – Desirable | Yellow — Decline | Red – Hazardous

Black neighborhoods were unsurprisingly labeled as hazardous. Even though redlining was banned more than 80 years ago, its impact still adversely affects Black people. Here is a short video on the history of redlining: How Redlining Shaped Black America As We Know It.

Know The Importance of a Credit Score

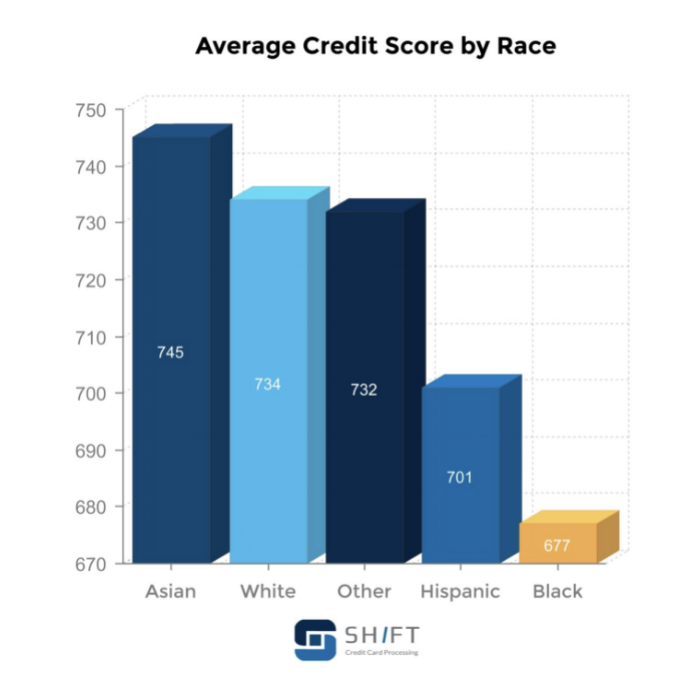

A good credit score is an important part of financial freedom and needed to build generational wealth. It’s a financial tool that determines if you are eligible for loans, renting an apartment, utilities, a cell phone plan, credit cards, and so much more. Black and brown people typically have a lower credit score (or none at all) when compared to other racial groups. This article from CNBC – “Black and Hispanic Americans often have lower credit scores — here’s why they’re hit harder” – tells how a majority of Black Americans are living paycheck to paycheck, which can affect their payment history and the rate at which they use credit. Here is a chart from Shift Processing that shows the breakdown of credit score by race:

I encourage interested readers to watch this short video by the Money Expert to help improve your credit score: “3 Hacks to Improve Your Credit Score.”

Build Wealth

There are many ways you can build and maintain wealth. Examples include buying real estate, creating your own small business, and investing in the stock market.

- Saving

The first and most important aspect of any generational wealth-building is saving. It takes practice and a plan, but saving money is a necessary habit. Bills and other life expenses might interfere; however, everyone is able to put away a portion of their check for safekeeping. Your savings account should hold three to six months’ worth of essential expenses, in case of emergencies or instability as we saw in 2020. If you are having trouble with saving, it’s best to record your expenses and prioritize your spending.

- Investing in Property

You can build equity and wealth by buying property. When you pay down your property mortgage, you start to build equity, which is an asset that is part of your net worth. Then, you will have the leverage to buy more properties. Buying more properties will increase cash flow and will start building your generational wealth.

Additionally, most lenders have grants for first-time home buyers.

- The Stock Market

Stocks, ETFs (Exchange Traded Funds), bonds, or cryptocurrency have significant risks for people new to the market but can provide long-term growth and income for you when used wisely and with patience. These are the types of investments that allow you to buy and own a fraction of a corporation by investing just a small amount of money. Don’t make a move before reading up on and understanding what/where you are investing in. For example, when Elon Musk hosted Saturday Night Live, and explained the cryptocurrency Dogecoin, millions watched its value fluctuate for days after. Even though there is a risk, don’t be afraid to start researching your options.

Watch this interview by the Breakfast Club Power 105.1 FM on how a young Black man that was once incarcerated is now considered a Wallstreet Trapper. Also, you could take a class to learn more about the stock market from folks who have been through these processes and can meet you at your experience level, for example, Modern Blk Girl and Brother Polight.

- Starting a Small Business

Owning a business is not for everyone, but for those who strive to own one, make sure to create something you love and make sure it is sustainable. Start with something you’re interested in. What do you like? If you’re a health enthusiast, you could become a trainer, nutritionist, herbalist, sell gym clothes, or even own a gym. Start small to reduce unexpected expenses, adjust your strategies as you learn about your business, and maintain a profit while avoiding unmanageable debt.

Support Other Black-Owned Businesses

African Americans’ spending power is at $1.2 trillion annually. However, our dollar circulates no more than six hours in our community. In comparison, a Jewish community’s dollar circulates 20 days, and the dollar circulates for 30 days in Asian communities. If Black communities supported Black businesses more, we would see an improvement in money circulation in our community and an increase in Black generational wealth.

Some people don’t support Black businesses because of the stereotype that Black businesses have poor customer service. However, how many of us have witnessed a rude encounter between a white business owner and a Black customer? Yet, Black people continue to support these establishments.

It is quite understandable that good customer service goes a long way, but instead of not supporting Black businesses because of a problem with customer service, provide constructive criticism and give Black businesses the chance to improve.

Here are two comprehensive lists of Black-owned businesses in Chicago:

Inside Hook: 100 Black-Owned Businesses

Black-Owned Chicago

Thanks to our partners. And thanks for reading.

I am not an expert of knowing how to build wealth, but these resources and tips have been necessary steps for me as I continue to learn the value of earning and saving money. Thanks to Fifth Third Bank and BMO Harris, as they will provide courses that will allow the Changing Voices Ensemble to gain financial literacy and get started planning their own strategies for build generational wealth.

Jazmine Clark

Executive Assistant, Storycatchers Theatre

Thanks for the information! It was very helpful.